The arrival of Jio BlackRock broking is a seismic shift for the Indian stock market. The industry is buzzing with anticipation now that Jio BlackRock Broking Pvt Ltd has received approval from SEBI (Securities and Exchange Board of India, the country’s capital markets regulator) to start operations as a full-fledged brokerage firm. But what does this mean for existing players like Zerodha? And more importantly, what does it mean for you as an investor?

The New Giant Enters the Ring

On June 27, 2024, the new Jio BlackRock broking venture received the green light from SEBI to commence operations. This isn’t just another brokerage firm – it’s a powerhouse combination of Jio’s massive distribution network and BlackRock’s global investment expertise. The company is a wholly owned subsidiary of Jio BlackRock Investment Advisers, which itself is a 50:50 joint venture between Jio Financial Services: A Sleeping Giant Ready To Roar? and BlackRock Inc.

The timing couldn’t be more strategic. India’s retail investment participation remains limited to roughly 10 crore people out of a population of over 1.4 billion. There’s enormous untapped potential waiting to be unlocked.

Zerodha’s Surprising Reaction: “Great News”

Here’s where it gets interesting. Nithin Kamath, CEO of Zerodha – one of India’s largest discount brokerages – welcomed this development with open arms. His reaction? “Great news for Indian markets.”

But why would a competitor’s entry be good news? Kamath’s reasoning is refreshingly mature and market-focused.

The Participation Problem

Kamath identifies a critical issue plaguing Indian markets: lack of breadth in participation. Currently, Indian markets are “largely limited to the top 10 crore Indians.” This narrow participation base limits market depth and liquidity.

The entry of Jio BlackRock broking could be the catalyst needed to expand this base significantly. As Kamath puts it, “If anyone can expand the markets beyond the top 10 crore Indians, it’s probably Jio with all its distribution might.”

The Positive Side: Market Expansion Benefits Everyone

Massive Distribution Network

Jio’s reach is unparalleled in India. With hundreds of millions of customers across telecom, digital services, and now financial services, they have the infrastructure to reach investors who were previously outside the formal investment ecosystem. This strategy of tapping a vast user base mirrors the ambitions of other financial giants, like Bajaj Finserv, which is also targeting a massive customer base for its diverse offerings.

Digital-First Approach

The joint venture emphasizes “easily accessible and digital-first solutions,” which aligns perfectly with India’s digital transformation journey. This could make investing more accessible to tech-savvy younger generations.

Increased Market Liquidity

More participants mean more market liquidity (the ease with which an asset can be bought or sold without causing a significant change in its price). This benefits all market participants through better price discovery and reduced volatility. For more details, you can explore the concept on Investopedia.

Competition Drives Innovation

The entry of a well-funded player like Jio BlackRock broking will likely accelerate innovation across the industry, ultimately benefiting investors through better products and services.

The Flip Side: Potential Challenges and Concerns

Deep Pockets, Aggressive Pricing

With BlackRock’s global resources and Jio’s financial backing, the new entrant could engage in aggressive pricing strategies that might pressure existing players’ margins.

Market Concentration Risks

While Jio’s distribution is an advantage, it also raises questions about market concentration. If one player becomes too dominant, it could reduce competition in the long run.

Regulatory Scrutiny

Large conglomerates entering multiple financial services sectors often attract regulatory attention, which could impact operational flexibility.

Customer Acquisition Battles

The industry might witness intense customer acquisition battles, potentially leading to unsustainable business practices. This isn’t happening in a vacuum; the financial services space is already heating up with other players also vying for investor attention, as seen with the buzz around the upcoming HDB Financial IPO.

Kamath’s Contrarian View: Why He’s Not Worried

It’s Not About Deep Pockets

Kamath makes a fascinating observation: “This is not a business where having deep pockets means you have a large moat.” Unlike capital-intensive industries, broking success depends more on execution, customer service, and innovation than pure financial muscle.

The Real Competition

According to Kamath, the real threat comes from “first-generation founders who are running, breathing, and always thinking about broking.” These are the passionate entrepreneurs who understand the nuances of the business and can adapt quickly to changing market conditions.

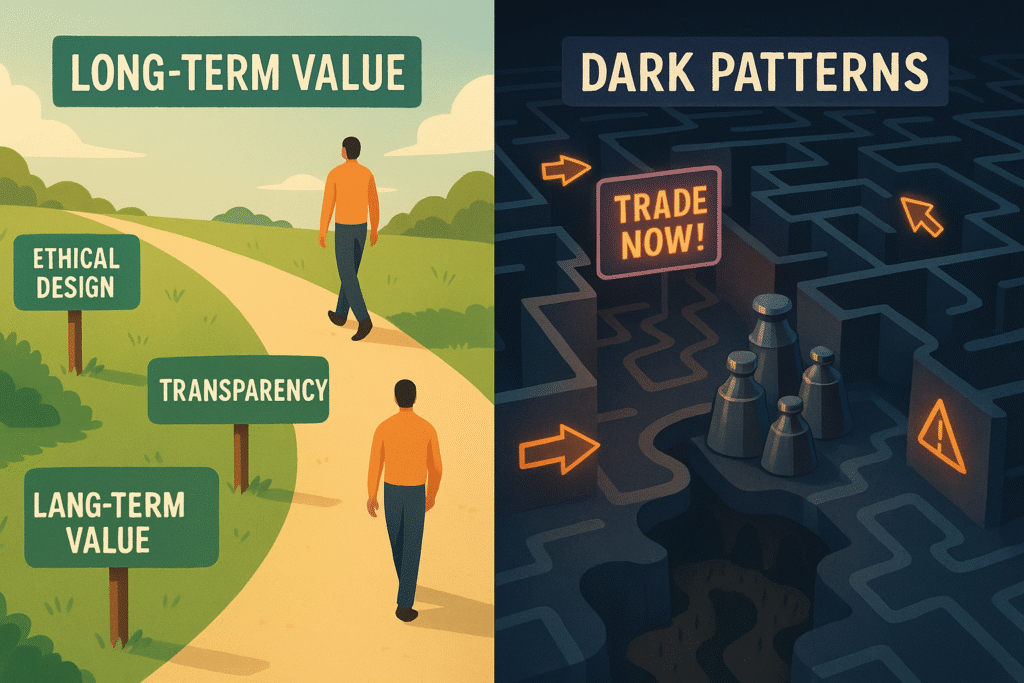

Zerodha’s Philosophy: Beyond Vanity Metrics

Kamath used this opportunity to reinforce Zerodha’s core principles:

- No pressure to trade: Unlike traditional brokerages that profit from high trading volumes, Zerodha avoids pushing customers to trade unnecessarily.

- Ethical design: No dark patterns (user interface tricks designed to mislead users into doing things they didn’t intend to, like making unintended purchases or trades). You can read about the impact of dark patterns in finance on The Economic Times.

- Long-term focus: “Most of our product decisions are based on the idea that customers do better in the long run when they trade less.”

- Transparent pricing: No bait-and-switch tactics with pricing plans.

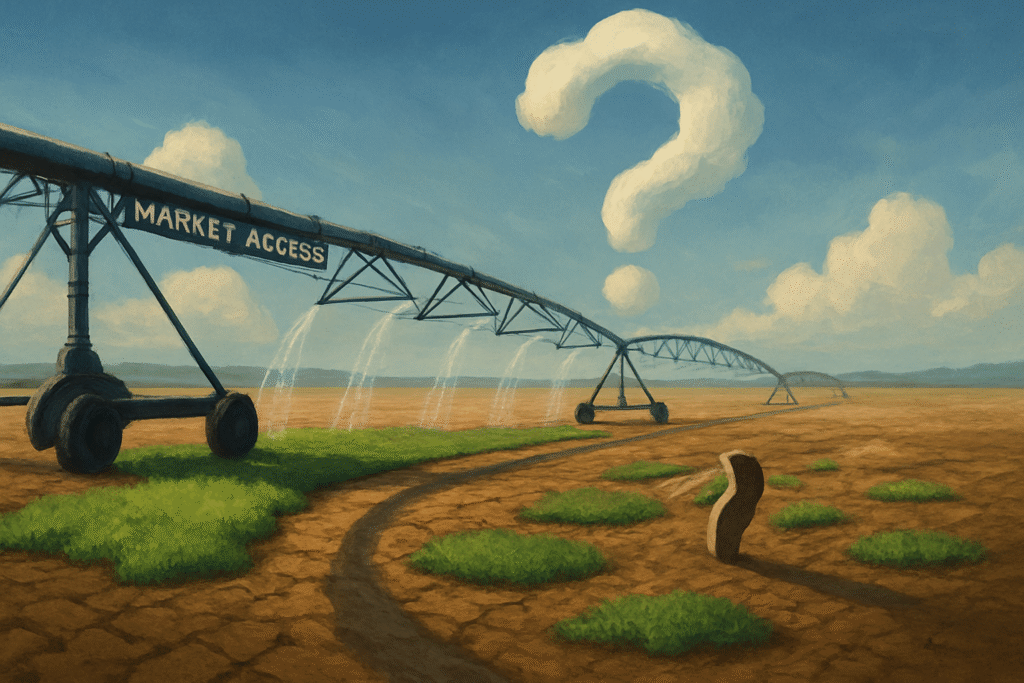

The Unanswered Question: Do Indians Have Money to Invest?

Kamath raises a crucial point often overlooked in expansion discussions: “As for how many new Indian investors have the money to invest in the market, I don’t know.”

This highlights a fundamental challenge. While expanding access is important, the success of mass-market expansion depends on the financial capacity of new participants. India’s per capita income, savings rates, and disposable income patterns will ultimately determine how many new investors can meaningfully participate.

What This Means for Investors

More Choices, Better Services

Increased competition from players like Jio BlackRock broking typically leads to better services, lower costs, and more innovative products for investors.

Potential for Market Volatility

As new participants enter the market, we might see increased volatility as these investors learn the ropes.

Educational Opportunities

New entrants often invest heavily in investor education, which could improve overall market literacy.

Technology Innovation

Competition will likely accelerate technological innovation in trading platforms and investment tools.

The Road Ahead

The Indian broking industry is entering an exciting phase. While Jio BlackRock broking brings formidable resources and distribution capabilities, established players like Zerodha have operational experience and customer loyalty.

The ultimate winners will likely be those who can balance growth with customer-centricity, innovation with stability, and scale with personalization.

As Kamath humbly admits, “But yeah, I might be wrong.” The market has a way of surprising even the most experienced observers.

Key Takeaways for Investors

- Expect Fierce Competition: This new era, kicked off by Jio BlackRock broking, could lead to better services and potentially lower costs for you.

- Stay Focused on Fundamentals: Don’t get swayed by flashy marketing or promotional offers from any broker.

- Leverage Educational Resources: Take advantage of the increased focus on investor education that will likely emerge.

- Maintain a Long-term Perspective: Remember that successful investing is about long-term wealth creation, not frequent trading.

The Indian investment landscape is set for transformation. Whether this expansion benefits individual investors will depend on how well these new players balance growth ambitions with genuine customer value creation.

Disclaimer: This analysis is based on publicly available information and should not be considered as investment advice or a recommendation to buy or sell any securities. Past performance is not indicative of future results. Readers should consult with qualified financial advisors before making any investment decisions. The views expressed are for informational purposes only and do not constitute professional financial advice.