The Indian stock market just witnessed something remarkable – yet another IPO that grabbed headlines with triple-digit oversubscription numbers. Aditya Infotech, the video security company behind the CP Plus brand, made its debut on August 5, 2025, with all the fanfare of a blockbuster opening. But here’s what every investor needs to know: spectacular debuts don’t guarantee spectacular futures.

My core belief remains unchanged – financial knowledge should be accessible to everyone, and it’s our mission to cut through the noise with clarity and a touch of reality check. Today, let’s examine what made this IPO sizzle and what questions smart money should be asking in this detailed Aditya Infotech IPO analysis.

The Company That Caught Everyone’s Attention

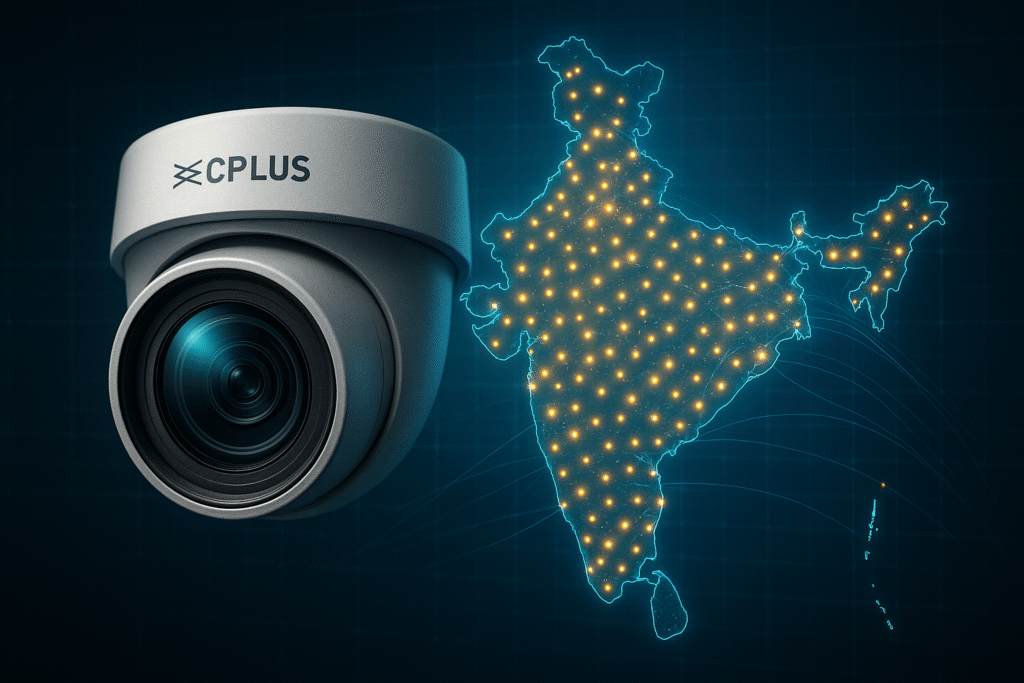

What Aditya Infotech Actually Does

At its core, Aditya Infotech operates in the video security and surveillance space, primarily known for its CP Plus brand. The numbers paint an impressive distribution picture:

- Geographic reach: Over 550 cities and towns

- Distribution network: More than 1,000 distributors

- Integration partners: 2,100 integrators

- Product range: Smart home IoT cameras, AI-powered security systems, industrial surveillance equipment

This infrastructure positions the company strategically within India’s expanding digital security landscape.

The Financial Performance That Turned Heads

FY25 delivered some eye-catching numbers:

- Revenue: ₹3,123 crore

- Net profit: ₹351 crore

- Year-on-year profit growth: An astonishing 205%

That 205% profit growth deserves attention, raising the critical question: is this sustainable, or are we looking at a one-time jump?

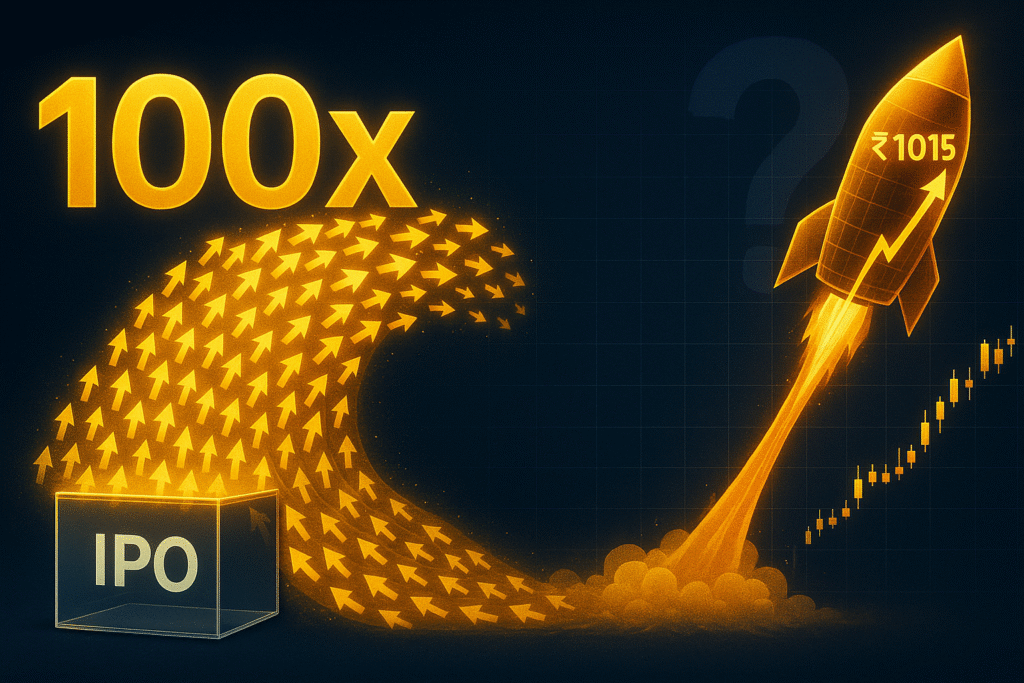

The IPO Numbers: Impressive, But What Do They Really Mean?

Subscription Statistics That Made Headlines

The IPO, priced at ₹675 per share, closed with oversubscription figures that dominated financial news:

- Overall oversubscription: 100.69 times

- QIB category: 133.21 times oversubscribed

- NII segment: 72 times oversubscribed

- Retail investors: 50.87 times oversubscribed

Total funds raised: A significant ₹1,300 crore.

The Listing Day Performance

When markets opened on August 5, 2025, Aditya Infotech shares delivered a powerful debut:

- Listing Premium: Over 50% on both NSE (₹1,015) and BSE (₹1,018).

- Market Capitalization: Approximately ₹11,900 crore.

The Anchor Investor Validation

Before the public, the company secured ₹582.3 crore from 54 institutional anchor investors, including global heavyweights like Goldman Sachs, the Government of Singapore, and the Abu Dhabi Investment Authority. This backing provides credibility, but remember – their goals might differ from yours.

The Positive Case: 3 Reasons Investors Are Excited

- Strategic Debt Reduction Plan

A whopping ₹375 crore from the fresh issue is earmarked for debt reduction. This focus on balance sheet strength signals a commitment to financial discipline, though a stronger balance sheet doesn’t always guarantee an immediate rally. - Market Positioning Advantages

The company’s established distribution network creates natural barriers to entry. Building these relationships doesn’t happen overnight, providing a solid competitive moat. - Sector Tailwinds

India’s security infrastructure spending is expanding rapidly, driven by urbanization, smart city initiatives, and rising security consciousness.

The Skeptical Questions Every Investor Should Ask

- Can Margin Consistency Be Maintained?

The security hardware business is competitive. Can Aditya Infotech protect its profitability against pricing pressure or supply chain issues? - Working Capital Efficiency Concerns

Distribution-heavy businesses live or die by their working capital management. Inventory, receivables, and payables will be key to watch in quarterly results. - Value Chain Evolution Strategy

Can the company evolve beyond distribution into higher-margin integrated solutions or analytics? Standing still in tech means falling behind. - Concentrated Promoter Control

While market leadership is an advantage, long-term valuation depends heavily on management’s execution. This is a vital point in any Aditya Infotech IPO analysis.

What Smart Investors Should Monitor Going Forward

- Quarterly Performance: Keep an eye on revenue growth, margin trends, and debt reduction progress.

- Strategic Moves: Watch for new products, acquisitions, or international expansion plans.

- Competitive Landscape: Monitor how the company responds to new tech trends like AI and cloud integration.

The Bottom Line: Beyond the IPO Euphoria

Aditya Infotech’s strong debut reflects genuine market interest. The oversubscription numbers indicate massive investor appetite, and institutional backing provides validation.

However, spectacular listings don’t guarantee spectacular long-term performance. The real test begins now – in quarterly earnings calls, strategic execution, and market adaptation.

For potential investors: The stock’s current premium pricing likely reflects much of the near-term optimism. Focus on fundamentals, not hype.

For existing shareholders: The next 12-18 months will be crucial. Monitor the company’s ability to deliver on its promises.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.