India’s electric vehicle revolution is racing ahead at breakneck speed, but there’s a tiny component – barely the size of your thumb – that could slam the brakes on this ambitious journey. The rare earth magnet crisis unfolding between India and China isn’t just another trade dispute; it’s a wake-up call that exposes the fragile foundations of our EV dreams.

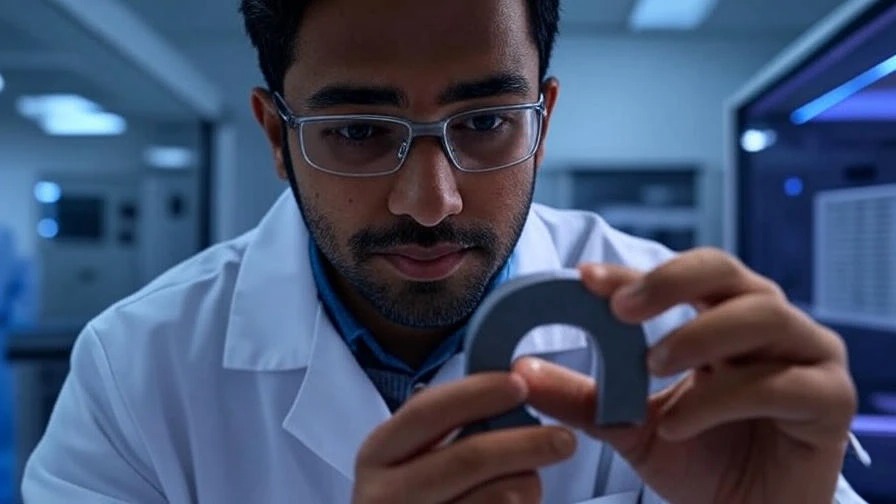

The Invisible Giant Inside Every EV

Walk into any showroom today, and you’ll see gleaming electric cars promising a cleaner future. What you won’t see is the small but mighty rare earth magnet buried deep inside each vehicle’s motor. These magnets are the unsung heroes of the EV revolution, powering the Permanent Magnet Synchronous Motors that give electric vehicles their superior torque and efficiency.

Think of it this way: without these magnets, an EV is like a smartphone without a battery – technically impressive but functionally useless. They’re not just in EVs either. Your car’s power steering, windshield wipers, and dozens of other components depend on these magnetic powerhouses.

China’s Masterstroke: When Supply Chains Become Weapons

In April 2025, Beijing dropped a bombshell that sent shockwaves through India’s automotive corridors. New export restrictions on rare earth elements and finished magnets turned what was once a smooth supply chain into a bureaucratic nightmare. The message was clear: China controls the tap, and it can turn it off whenever it wants.

The numbers tell a sobering story. India imported 540 tonnes of magnets last year, with over 80% coming from China. By May 2025, around 30 Indian companies had filed import requests, but Chinese authorities hadn’t approved a single one. The approval process, once routine, now stretches to 45 days or more.

Major players like Bosch India, TVS Motor, and Sona Comstar found themselves in an unexpected queue, waiting for Beijing’s nod. It’s like watching a high-stakes game of musical chairs, except the music might never start again.

The Domino Effect: When Small Parts Create Big Problems

Here’s where the story gets interesting – and concerning. A single rare earth magnet costs less than ₹1,000, but its absence can shut down an entire production line worth crores. It’s the automotive equivalent of a missing screw grounding a ₹500-crore aircraft.

The timing couldn’t be worse. India’s automakers are preparing to launch over a dozen new EV models, mostly built on platforms that require these Chinese magnets. With current inventory levels lasting only 4-6 weeks, production disruptions could hit as early as July 2025.

The ripple effects extend far beyond EVs. Traditional petrol and diesel vehicles also use these magnets for power steering and other systems. Even the booming two-wheeler segment, which forms the backbone of India’s mobility ecosystem, faces potential disruption.

The Silver Lining: Crisis as Catalyst

Every crisis carries within it the seeds of opportunity, and India’s rare earth predicament is no exception. The government’s response has been swift and multi-pronged, suggesting that this shock might be exactly what the country needed to break free from Chinese dependence.

Commerce Minister Piyush Goyal’s characterization of this as a “wake-up call” wasn’t just political rhetoric – it was a strategic acknowledgment that India’s manufacturing ambitions require supply chain sovereignty.

The immediate response focuses on building strategic inventories and diversifying suppliers. Countries like Vietnam, Brazil, and Australia are emerging as potential alternatives, though scaling up will take time.

More importantly, India is accelerating domestic capabilities under the Production Linked Incentive scheme. The country’s vast rare earth reserves, particularly in Odisha and Andhra Pradesh, could become the foundation for indigenous magnet manufacturing.

The Long Game: From Dependence to Independence

The most promising development might be India’s diplomatic outreach to Central Asian nations. Kazakhstan, Kyrgyzstan, and Uzbekistan possess significant rare earth deposits, and the recent India-Central Asia Dialogue signals a new chapter in resource cooperation.

This isn’t just about magnets – it’s about building a resilient ecosystem for critical minerals that power the modern economy. From solar panels to wind turbines, smartphones to satellites, rare earths are the building blocks of technological progress.

India’s automotive sector, which contributes over 7% to GDP and employs millions, cannot afford to remain hostage to a single supplier. The current crisis, painful as it is, might force the structural changes needed for long-term competitiveness.

The Reality Check: Challenges Ahead

Let’s be honest about the obstacles. China’s 90% dominance in rare earth processing didn’t happen overnight – it’s the result of decades of strategic investment and environmental trade-offs. Building comparable capabilities will require significant capital, technology transfer, and time.

The environmental challenges are real too. Rare earth processing is messy business, involving chemicals and processes that require careful handling. India will need to balance its manufacturing ambitions with environmental responsibilities.

There’s also the question of cost. Chinese magnets are cheap partly because of scale and government subsidies. Indian alternatives might initially cost more, potentially impacting EV affordability – a crucial factor in mass adoption.

The Road Ahead: Cautious Optimism

The rare earth magnet crisis reveals both the vulnerabilities and the opportunities in India’s EV journey. While the immediate challenges are real, the long-term response could transform India from a dependent importer to a self-reliant manufacturer.

The key lies in viewing this not as a temporary trade dispute but as a permanent shift toward supply chain diversification. Companies that invest in alternative sources and domestic capabilities today will be better positioned tomorrow.

For investors and industry watchers, this crisis underscores the importance of supply chain resilience in evaluating automotive companies. The winners will be those who adapt quickly to the new reality.

India’s EV revolution might face a temporary speed bump, but it’s far from derailed. Sometimes, the best paths forward are discovered when the familiar routes are blocked.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. The automotive sector faces multiple challenges and opportunities that can impact company performance. Readers are advised to conduct their own research and consult with financial advisors before making any investment decisions. Past performance does not guarantee future results.