Apple’s India Strategy is officially in the spotlight after a move that’s sending shockwaves through Silicon Valley and beyond. The tech giant’s decision to elevate Sabih Khan to Chief Operating Officer isn’t just another corporate reshuffle – it’s a strategic chess move that validates its manufacturing pivot and could reshape global power dynamics.

The Architect of Apple’s Supply Chain Revolution

Sabih Khan’s story reads like a modern American dream with a global twist. Born in Moradabad, Uttar Pradesh, this 59-year-old executive has quietly become one of the most powerful figures in global technology. His journey from a small Indian city to the C-suite [The C-suite refers to a corporation’s most senior executive titles, often starting with “Chief,” like CEO, COO, and CFO] of the world’s most valuable company is nothing short of remarkable.

After moving to Singapore during his school years, Khan landed in the United States for higher education. Armed with dual bachelor’s degrees in Economics and Mechanical Engineering from Tufts University and a master’s from Rensselaer Polytechnic Institute, he began his career at GE Plastics before joining Apple in 1995.

What makes Khan’s appointment particularly significant is his three-decade tenure. He’s not an outsider; he is an insider who was instrumental in building the very global supply chain empire that he now officially leads. You can learn more about his role on Apple’s official leadership page.

Why This Appointment Cements Apple’s India Strategy

Khan steps into the shoes of Jeff Williams, who’s retiring after nearly 30 years. The COO role at Apple is arguably the second most powerful position in the company. This isn’t just about managing operations – it’s about orchestrating a $3.28 trillion company’s global footprint, with Apple’s India Strategy now a central pillar of that plan.

Tim Cook’s praise for Khan as a “brilliant strategist” and “one of the central architects of Apple’s supply chain” isn’t corporate speak. It’s a testament to Khan’s role in pioneering the manufacturing technologies that make this massive shift possible.

The Core of Apple’s India Strategy: A Game-Changing Shift

Here’s where things get interesting. Khan’s elevation comes at a crucial moment when Apple’s India Strategy is in full swing, aggressively shifting significant iPhone production from China to India. The numbers are staggering.

The Upside of Apple’s India Push

- Diversification Benefits: Currently, about 20% of Apple’s global iPhone production comes from India, up from 14% in 2024. That’s roughly $22 billion worth of production value.

- Risk Mitigation: By reducing dependence on China, Apple is building supply chain resilience [The ability of a supply chain to withstand, adapt to, and recover from disruptions] against potential geopolitical and economic disruptions.

- Economic Impact: This shift aligns perfectly with India’s “Make in India” initiative [A major government initiative launched in 2014 to encourage companies to manufacture their products in India. You can read more at the official portal: https://www.makeinindia.com/home], bringing substantial investments and job creation.

- Talent Pool: India offers a massive, skilled workforce and a rapidly developing manufacturing ecosystem.

3 Hidden Challenges Nobody Talks About

But this transition isn’t without its hurdles, and they’re significant for the success of Apple’s India Strategy.

1. China’s Continued Component Dominance

Despite the shift in final assembly, China still maintains a “stranglehold” on component manufacturing. This means India’s operations are largely focused on assembly, with heavy reliance on Chinese parts. This dependency is a recurring theme in India’s industrial ambitions, a challenge seen clearly in the ongoing battle between India’s EV Dreams vs China’s Magnet Monopoly. It’s like moving the final stage of a race while keeping the entire track in the same location.

2. Political Headwinds in the US

The move faces vocal opposition from certain political quarters in the United States. There’s pressure on Apple to bring manufacturing back to American soil instead of shifting it to another foreign country. This creates a complex political balancing act, with ongoing debates about global trade that you can explore in-depth via institutions like the Council on Foreign Relations.

3. Immense Logistical Complexities

Rerouting vast, intricate supply chains isn’t like changing a shipping address. It requires massive investments, time, and the delicate task of building new infrastructure and supplier networks from the ground up.

The Indian-Origin Executive Phenomenon

Khan joins an elite club of Indian-origin executives leading major global corporations. Alongside Satya Nadella at Microsoft and Sundar Pichai at Google/Alphabet, he represents a growing trend of Indian talent at the helm of tech giants. This phenomenon speaks volumes about the global recognition of Indian leadership, strategic thinking, and operational excellence. It’s a trend that mirrors the rise of Indian corporations on the world stage, with giants like Reliance Industries breaking into the global tech elite.

What This Means for Investors and Markets

From a market perspective, Khan’s appointment signals Apple’s deep commitment to supply chain diversification. This could have several implications:

- Reduced Geopolitical Risk: Less dependence on any single country could make Apple more resilient to trade wars.

- Potential Cost Benefits: India’s competitive manufacturing costs could improve Apple’s margins over time.

- Market Access: Stronger Indian operations could help Apple better penetrate the massive Indian consumer market.

The Risks Nobody Wants to Discuss

However, investors should also consider the potential downsides:

- Transition Costs: Moving supply chains is expensive and could impact short-term profitability.

- Quality Concerns: New manufacturing locations might face initial quality control challenges.

- Political Pressure: Ongoing pressure from various governments could force further costly relocations.

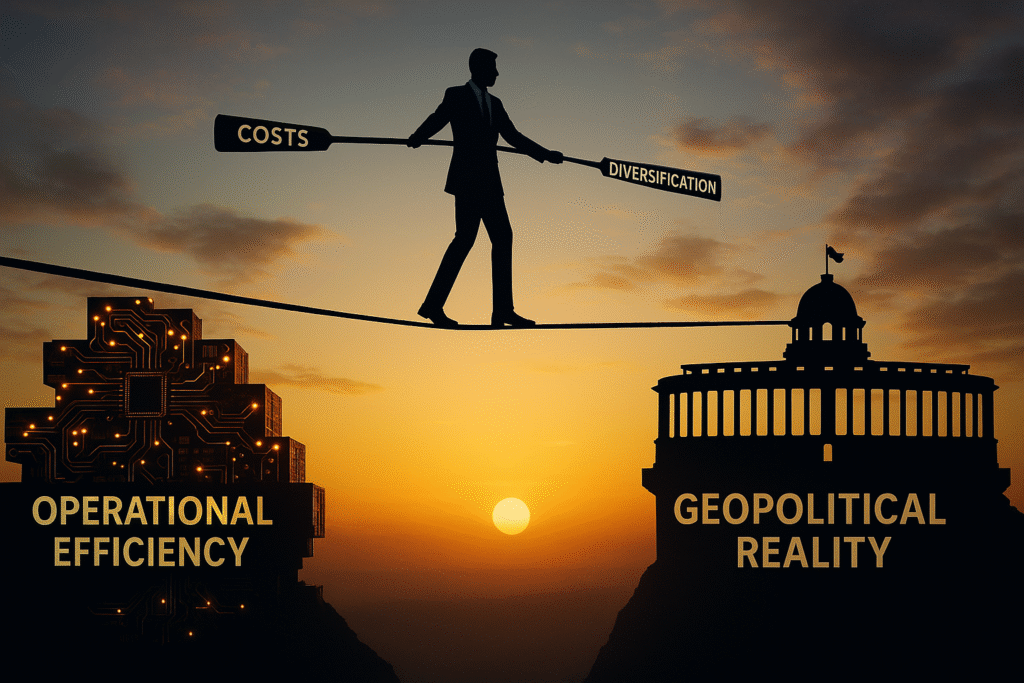

Looking Ahead: A Complex Balancing Act

Khan’s success as COO will depend on his ability to navigate these complex forces. He must balance strategic diversification with operational efficiency, political pressures with business realities, and short-term costs with long-term benefits.

The coming years will be crucial in determining whether Apple’s India Strategy pays off. Under Khan’s leadership, the company must prove this shift enhances, rather than complicates, its global operations.

The Bottom Line

Sabih Khan’s promotion is more than a leadership change – it’s Apple’s bet on a diversified, resilient future, with Apple’s India Strategy at its core. His experience makes him uniquely qualified to lead this transformation.

While the shift to India offers significant long-term advantages, the immediate path will be challenging. This delicate balance is at the heart of what some are calling Apple’s India gamble, a high-stakes game where geopolitical moves could have massive consequences. How Apple manages these dual forces will be a critical storyline to watch. For now, one thing is certain: Apple isn’t just changing its supply chain – it’s reshaping the future of global manufacturing.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice or a recommendation to buy or sell any securities. Always consult with a qualified financial advisor before making any investment decisions. Market conditions can change rapidly, and past performance doesn’t guarantee future results.