The potential India Su-57 Deal stands at a crossroads that could define the nation’s military might for the next three decades. The country’s desperate search for a fifth-generation fighter jet has taken an unexpected turn, with Russia’s Su-57 emerging as a potential game-changer. But is this the strategic masterstroke India needs, or a dangerous gamble that could backfire spectacularly?

The Ticking Clock of National Security

Pakistan’s growing interest in Chinese fifth-generation jets has set alarm bells ringing in New Delhi. With our indigenous Advanced Medium Combat Aircraft (AMCA) still years away from reality, India faces a critical capability gap that enemies could exploit. The Indian Air Force is caught between immediate threats and long-term strategic goals.

The numbers paint a stark picture. While India’s AMCA won’t see action before 2035, regional adversaries are rapidly modernizing their air forces. This 10-year window represents a dangerous vulnerability that could compromise our aerial dominance in South Asia.

• Why the Su-57 Suddenly Makes Sense

The Russian Su-57 wasn’t always on India’s radar. In fact, we walked away from the joint development program in 2018, citing serious concerns about the aircraft’s capabilities. But three key developments have changed the equation for a potential India Su-57 Deal:

- Combat-Proven Performance: Unlike paper promises, the Su-57 has now been operationally deployed in conflict zones. Both Russian and Western military analysts acknowledge its credible combat performance, addressing earlier skepticism about its real-world effectiveness.

- Engine Breakthrough: The aircraft’s second-stage engine, Izdeliye 30, is undergoing flight testing. This upgrade directly addresses India’s previous concerns about supercruise capability (the ability to fly at supersonic speeds without using fuel-guzzling afterburners).

- Technology Transfer Promise: Russia has offered complete technology transfer and co-production at Hindustan Aeronautics Limited’s Nashik facility. This aligns perfectly with India’s “Make in India” initiative while providing industrial participation opportunities.

The Game-Changing Two-Seat Variant

Russia’s renewed focus on a dual-seat Su-57 variant specifically targets Indian requirements. This isn’t just about adding an extra seat – it’s about transforming the aircraft into a force multiplier that could revolutionize Indian air combat doctrine.

Simplified Training: The two-seat configuration makes pilot transition significantly easier, crucial for complex fifth-generation systems. The Indian Air Force has historically preferred twin-seat trainers, making this a natural fit.

Enhanced Mission Management: A second crew member reduces pilot workload, enabling more efficient management of complex systems, data fusion, and electronic warfare operations. In modern network-centric warfare (a military doctrine that translates an information advantage into a competitive advantage through the robust networking of well-informed forces), this advantage cannot be overstated.

Drone Command Capability: The two-seat Su-57 can control unmanned aerial vehicles like the S-70 Okhotnik. This ability to command unmanned wingmen in contested airspace provides exponential force multiplication. For more details on this advanced drone, you can read about the S-70 Okhotnik-B.

• The Geopolitical Balancing Act

India’s defense procurement decisions have become a delicate 360-degree geopolitical balancing act. Maintaining good relations with the United States while preserving strategic autonomy creates complex challenges for the India Su-57 Deal.

Any potential deal with America for F-35A fighters would likely come with strings attached – most notably, abandoning Russian S-400 air defense systems in favor of American THAAD (Terminal High Altitude Area Defense, an American anti-ballistic missile defense system) batteries. India’s limited fiscal capacity to deploy THAAD across its vast borders makes this economically unfeasible.

Washington may have implicitly allowed New Delhi to consider the Su-57 instead, recognizing India’s resistance to abandoning existing Russian partnerships. This creates a unique window of opportunity for the India Su-57 Deal to proceed.

The Self-Reliance Counter-Argument

Not everyone in India’s defense establishment supports importing another foreign fighter jet. A powerful counter-narrative advocates for complete rejection of all imported fifth-generation fighters, prioritizing indigenous development instead.

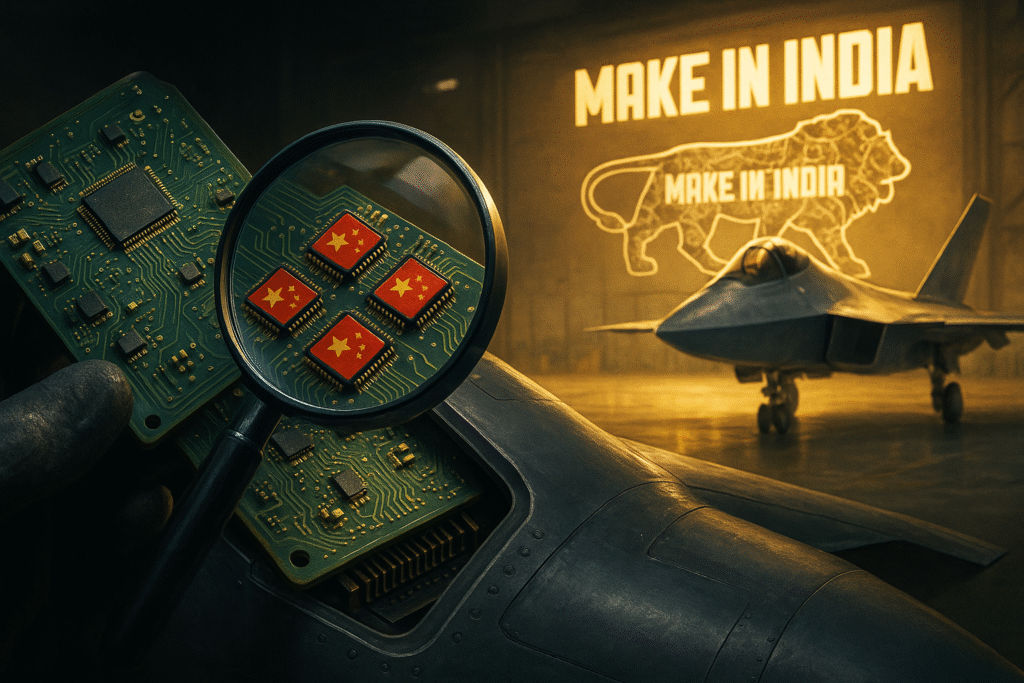

Security Concerns: Critics highlight that a significant portion of Su-57 electronics, avionics components, and chips are sourced from China. Former Air Force officer Ajay Ahlawat warns: “Imagine being in a shooting war with your equipment vendor.”

Dependency Risks: Veterans like former Air Chief Marshal RKS Bhadauria argue that India must break free from foreign dependency to achieve true air power. They view the AMCA program as a fundamental test of India’s ability to build what it needs without external help.

Strategic Patience: Proponents of self-reliance argue against “panic buys,” emphasizing that India’s answer lies in stronger air defenses and strategic measures to counter threats while indigenous capabilities mature.

• The Economic Reality Check

The financial implications of this decision extend beyond mere procurement costs. A small batch of 18-24 twin-seat Su-57s could serve as a strategic interim solution, providing advanced capabilities while longer-term programs mature.

The Russian proposal includes full technology transfer and co-production collaboration, potentially creating thousands of jobs and building indigenous manufacturing capabilities. This industrial participation could significantly offset the initial investment through export opportunities and domestic value creation.

However, critics question whether resources should be diverted from the AMCA program, potentially delaying India’s path to complete self-reliance in fighter aircraft development.

The Verdict: A Decision That Will Define Decades

India faces a choice between pragmatic interim solutions and idealistic long-term goals. The India Su-57 Deal offers immediate capability enhancement with significant industrial benefits, but it conflicts with the powerful drive for complete self-reliance.

The next few months will reveal which path India chooses. This decision will shape our air power capabilities for decades while setting precedents for future defense procurement strategies.

The stakes couldn’t be higher. Get it right, and India emerges as a regional air power with advanced indigenous capabilities. Get it wrong, and we risk prolonged dependency or dangerous capability gaps.

• What This Means for India’s Future

Regardless of the final decision, this debate highlights India’s evolving defense priorities. The push for indigenous capabilities is gaining momentum, but immediate security needs cannot be ignored.

The AMCA program represents more than aircraft development – it’s a test of India’s technological ambitions and industrial capabilities. Success would position India among elite nations capable of developing advanced military aircraft independently. You can follow its progress on the official DRDO AMCA page.

However, the timeline realities mean that interim solutions may be necessary to maintain strategic balance in the region. The India Su-57 Deal, particularly the two-seat variant, offers unique advantages that align with India’s operational requirements and industrial goals.

Disclaimer: This analysis is for informational purposes only and should not be construed as a recommendation for any defense procurement decisions. Readers should consult qualified defense experts and official sources for specific policy guidance.