What Makes This Bonus Issue Special?

Nestle India’s last bonus issue dates back to 1996 – a staggering 29-year gap that makes this announcement historically significant. For context, when the company last issued bonus shares at a 1:2 ratio, many of today’s retail investors weren’t even born, and the landscape of the stock market India looked vastly different.

The upcoming board meeting has created a buzz that’s hard to ignore. The trading window was strategically closed from June 19 to June 28, 2025, indicating the company’s serious intent regarding the Nestle bonus 2025. With shares carrying a face value of Re 1, investors are eagerly waiting to learn the bonus ratio that could potentially reshape their holdings.

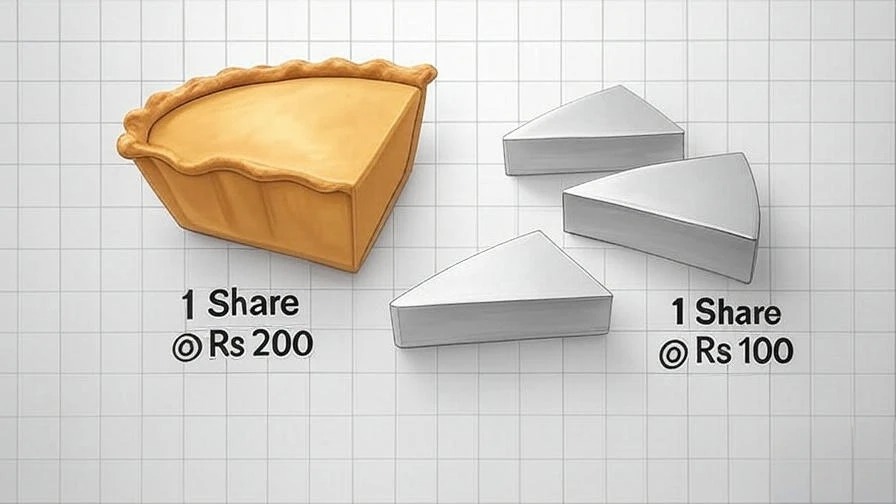

The Bonus Reality Check: What Actually Happens

Let’s cut through the excitement and understand the mechanics. When a company announces a Nestle India bonus issue, it’s essentially splitting your existing shares into more pieces of a smaller pie. If Nestle declares a 1:1 bonus and the Nestle India share price is Rs 200 before the ex-bonus date, expect it to adjust to around Rs 100 the next day.

The math is simple: you get double the shares, but each share is worth half the price. Your portfolio value remains the same immediately after the adjustment. The real benefit lies in improved liquidity and the psychological comfort of owning more shares at a lower price point.

The Bright Side: Why This Could Be Good News

Nestle India’s decision to consider a bonus issue after 29 years signals strong management confidence. The company has solid fundamentals to back this move:

Strong Market Position: With over 60% market share in the noodles segment, Nestle India dominates one of the fastest-growing FMCG categories. India represents the largest noodles market for the global Nestle group, providing significant leverage.

Expansion Drive: The company is investing Rs 9 billion in a new Odisha factory, focusing on prepared dishes and cooking aids. This expansion demonstrates management’s commitment to long-term growth.

Rural Strategy: The “RUrban” initiative has reached 27,730 distribution touchpoints across 208,500 villages. This rural penetration strategy positions the company well for India’s consumption growth story.

Diversification Success: Recent entry into petcare through Purina acquisition and focus on premium, healthier products shows strategic evolution beyond traditional categories.

Financial Stability: Despite Q4 FY25 challenges, the company maintained strong ROE (80-117%) and ROCE (110-161%) over the past five years, indicating efficient capital utilization.

The Dark Clouds: Challenges Investors Can’t Ignore

However, not everything is rosy in Nestle India’s world:

Declining Profitability: Q4 FY25 saw net profit drop 5.2% to Rs 8.85 billion despite revenue growth of 4.5%. This trend raises questions about operational efficiency.

Input Cost Inflation: Rising prices of coffee, cocoa, edible oils, and milk are squeezing margins. The company has been forced to implement small price hikes, which could impact volume growth in price-sensitive markets.

Stock Performance Concerns: The stock has declined nearly 7% over the past year, underperforming the broader market. Trading between a 52-week high of Rs 2,777 and low of Rs 2,115 shows significant volatility.

Intense Competition: The FMCG space is becoming increasingly competitive, with new players and changing consumer preferences putting pressure on traditional brands.

Export Challenges: While expanding to new markets like Maldives and Papua New Guinea, the company saw declines in North America, indicating mixed international performance.

The Verdict: Proceed with Caution

A bonus issue after 29 years is undoubtedly newsworthy, but smart investors should look beyond the headlines. Nestle India remains a fundamentally strong company with dominant market positions and strategic growth initiatives. The rural expansion, new factory investments, and diversification efforts show management’s forward-thinking approach.

However, the recent decline in profitability, rising input costs, and stock underperformance cannot be ignored. The bonus issue might provide short-term excitement and improved liquidity, but it doesn’t address these underlying challenges.

What Should Investors Do?

For existing shareholders, this bonus issue represents additional shares in a quality company, though at proportionally adjusted prices. Long-term investors with faith in India’s consumption story and Nestle’s brand strength might view this positively.

New investors should focus on the company’s ability to navigate current challenges rather than getting swayed by bonus announcements. Wait for the June 26 board meeting to understand the exact ratio, then evaluate whether the adjusted price levels offer attractive entry points.

The key lies in understanding that while bonus issues can be positive signals, they’re not automatic wealth creators. The real value comes from the company’s ability to grow earnings, expand market share, and deliver consistent returns to shareholders.

Final Word

Nestle India’s bonus consideration after 29 years marks a significant corporate milestone. While the move demonstrates management confidence and could improve stock liquidity, investors must evaluate the company’s operational performance and growth prospects rather than getting carried away by bonus euphoria.

The June 26 announcement will reveal the bonus ratio, but the more important question remains: Can Nestle India overcome its current challenges and deliver sustainable growth in an increasingly competitive market?

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice or a recommendation to buy or sell. Stock investments are subject to market risks, and past performance doesn’t guarantee future results. Please consult with a qualified financial advisor and conduct your own research before making investment decisions.