In the heart of India’s Silicon Valley, a curious and slightly old-fashioned trend is taking root. Amidst the QR codes that have become a permanent fixture, a new set of signs is popping up in small shops across Bengaluru, a city no stranger to headline-making local debates: “No UPI, Only Cash.” This isn’t a tech glitch; it’s a deliberate choice, a small-scale rebellion fueled by fears of a UPI GST crackdown. For a nation pushing hard for a “less-cash” economy, this return to paper money in its tech capital is a signal we can’t afford to ignore. What’s driving this sudden digital detox, and what does it reveal about the future of business in India?

THE FEAR FACTOR: WHEN CONVENIENCE MEETS COMPLIANCE

For years, the Unified Payments Interface (UPI), has been a game-changer for small businesses. It’s fast, cheap, and seamless. But for many vendors, this convenience has recently curdled into anxiety. The root cause? The Goods and Services Tax (GST), a system with its own set of successes and challenges.

The chatter on the streets began after some unregistered businesses reportedly received GST notices, triggering alarm about a potential UPI GST crackdown. Here’s the breakdown of their apprehension:

The Digital Trail: Every UPI transaction creates a permanent, traceable record. For businesses that have traditionally operated in the cash-based informal economy, this digital footprint suddenly felt like an unavoidable spotlight, highlighting every rupee earned.

The GST Threshold: The law is clear. Businesses with an annual turnover exceeding Rs 40 lakh from goods or Rs 20 lakh from services must register for GST. The notices were reportedly triggered when the tax department analyzed UPI data and found vendors whose transaction volumes had crossed these limits.

The Sticker Shock: For a small vendor, receiving a tax demand that could run into lakhs of rupees was a jolt. The immediate, instinctive reaction was to cut off the source of this scrutiny: UPI. By putting up “No UPI” signs, they hoped to fly back under the radar, away from the taxman’s watchful eye.

This is the negative side of the coin. For these entrepreneurs, the push towards digital formalization felt less like an opportunity and more like a trap.

THE OFFICIAL RESPONSE: IT’S NOT UPI, IT’S THE LAW

As the “No UPI” movement gained traction, the commercial tax department in Karnataka moved swiftly to clear the air. Their message was unequivocal: this isn’t an anti-UPI campaign; it’s a pro-compliance drive. The government’s clarification on the supposed UPI GST crackdown was firm.

Officials stressed that their focus isn’t on the method of payment, but on the income itself.

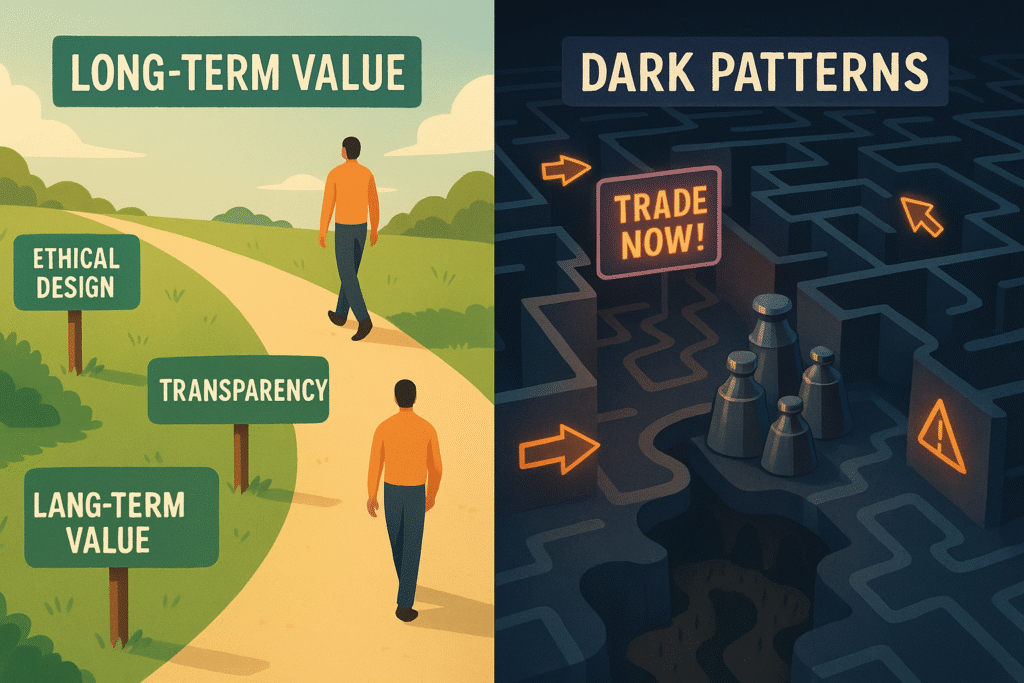

GST is Payment-Agnostic: The department clarified that GST is levied on the total business turnover, regardless of whether the payment is received via UPI, cards, bank transfers, or even hard cash. Avoiding UPI will not magically erase a business’s tax liability.

Data from All Sources: Tax authorities are collating data from all digital platforms, including point-of-sale (PoS) machines and payment aggregators, to build a complete picture of a business’s revenue. They aren’t just looking at UPI transactions.

A Push, Not a Punishment: The intent, they claim, is not to penalize but to formalize. The notices were sent to businesses legally required to register for GST but had not. The goal is to bring them into the tax net, ensuring a level playing field for all.

FINDING A MIDDLE GROUND: THE PATH TO FORMALIZATION

Recognizing the genuine fear among small traders, the tax department has initiated measures to soften the transition. This isn’t just about enforcement; it’s also about education.

Assistance and Guidance: Officials have been instructed to assist and educate vendors on how to become compliant, rather than simply issuing demands.

The Composition Scheme Lifeline: For smaller businesses, the government is actively promoting the Composition Scheme, a simpler tax scheme for small businesses with reduced compliance and lower tax rates. Traders with an annual turnover below Rs 1.5 crore can opt for this, paying a much lower, fixed-rate tax with simpler filing requirements.

Verification Before Taxation: Vendors who received notices are being asked to submit documents for verification. The final tax will only be levied on the actual taxable turnover, after excluding any exempt goods or services.

THE BIGGER PICTURE: A NATION AT A CROSSROADS

The Bengaluru episode is a micro-illustration of a much larger national story: the formalization of India’s massive informal economy. Digital payments, led by UPI, have punched a hole in the opaque wall of cash-based trade, making transactions visible. The fallout from the UPI GST crackdown highlights a major growing pain in this transition.

This is the great balancing act for India’s economy. On one hand, you have the government’s legitimate need to increase revenue and curb tax evasion. On the other, you have millions of small entrepreneurs who are the backbone of the economy, grappling with the challenges of the formal system even as they hold the potential to transform entire sectors.

The “No UPI” signs may be temporary, but they are a powerful symbol of this transition anxiety. The future of India’s digital dream depends on how we manage its human impact. The path forward requires a dance of firm enforcement, clear communication, and empathetic hand-holding, ensuring the digital economy is a platform for growth, not a reason for fear.

DISCLAIMER

This blog post is for informational purposes only and is based on publicly available news reports. It does not constitute financial or tax advice. Readers should conduct their own research and consult with a qualified professional before making any financial or business decisions.